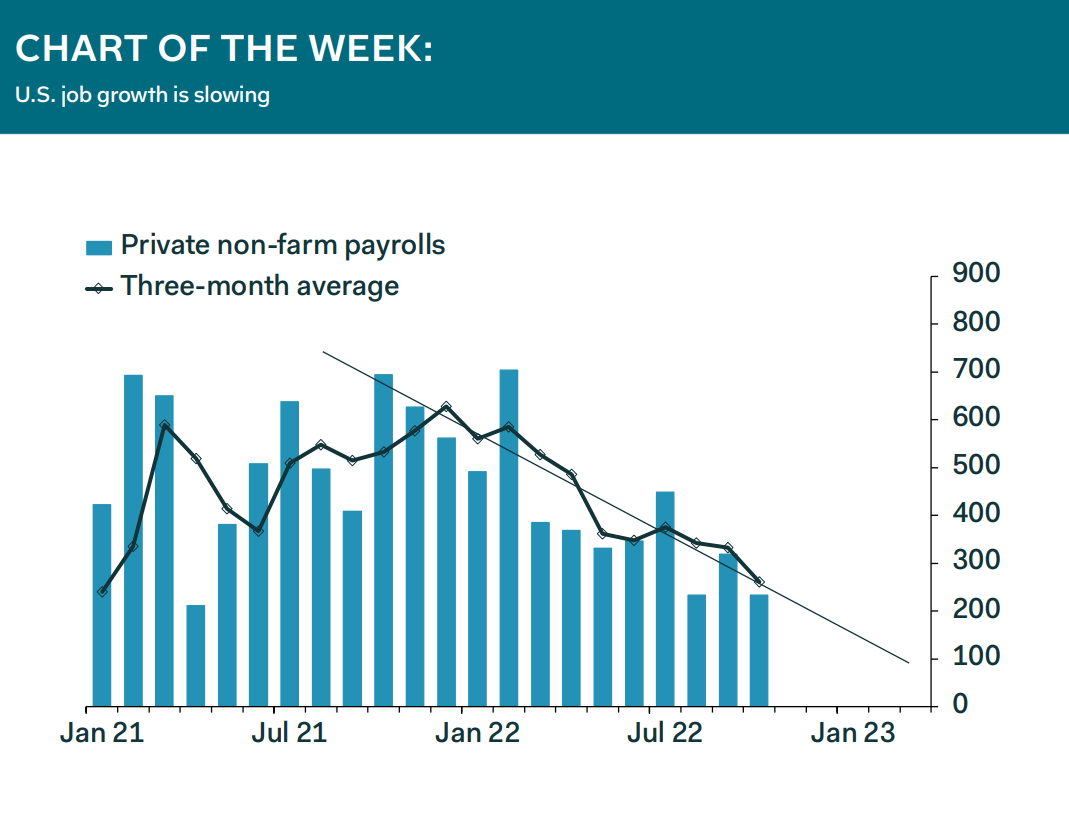

We don’t subscribe to the widely held view that Friday’s jobs report suggests that conditions in the U.S. labour market remain unchanged, and robust. To us, the data support the idea that job growth is slowing. Straight-line extrapolations are dangerous, but on the current trend, payrolls will hit 100K by Q1 next year, as our chart of the week slows. We also see evidence of slowing growth in wages, probably homing in on a rate that the Fed would be happy with, in the medium term. If we are right, markets will soon put pressure on the Fed to slow the pace of tightening, perhaps even to the point at which no rate hikes will be priced-in next year. The key factor of this story is that both the structural—re-hiring of workers laid off during Covid—and cyclical components of job growth are fading. The Fed

eventually will have to take this into account, which implies a slowing pace of rate hikes.

Ian Shepherdson, Chief U.S. Economist